Verify your PCBMTD amount 5. Income tax return for partnerships Form P.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Income tax return for partnerships.

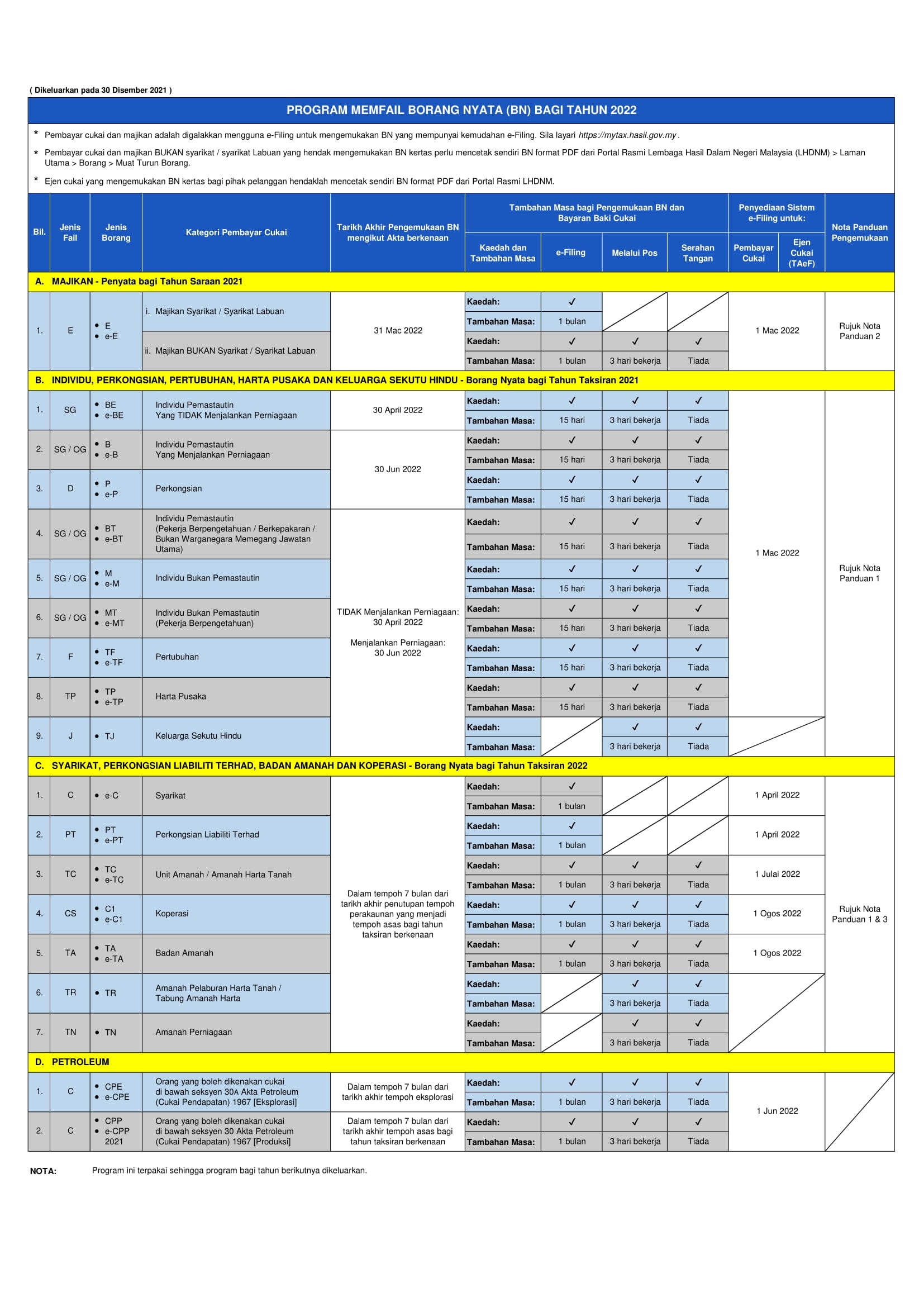

. According to the BE form resident people who do not engage in business the deadline for reporting income tax in Malaysia for manual filing in 2020 is 30 April 2021 and for e-filing in 2020 is 15 May 2020. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022. You can see the full amended schedule for income tax returns filing on the LHDN website.

Registration of a tax file can be done at the nearest Inland. Tax Offences And Penalties In Malaysia. Employment income e-BE on or before 15 th May.

Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a business. For further information kindly refer the Return Form RF Program on the. Income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period - based on method of submission Electronic filing 1 month April 30 2020 15 days.

The 2022 filing programme stipulates the due date for the submission of the RF ie Form BT e-BT for resident individuals who are non-citizen workers holding key positions. As the first deadline to file your income tax has just passed you may be wondering what could happen if you file your taxes late. Business income B Form on or before 30 th June.

Form EA Important Notes. The income tax deadline is usually on April 30 manual submission or May 15 e-Filing so you could set it some time at the start of April to give yourself extra time if anything goes wrong. However april 15 2022 is emancipation day.

Declaration report of companies Form E deadline. Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses. Individual Tax Relief in Malaysia.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. PERSONAL TAX Form BE 30 April 2022.

2022 tax filing deadlines. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Personal income tax filing Form BE deadline.

Income Tax For Foreigners Working in Malaysia 2021. Business income e-B on or before 15 th July Date of online submission may subject to change. Meanwhile the deadlines for the B form resident people who are engaged in business are 15 July for e-filing and 30 June for manual.

Yearly remuneration statement Form EA Deadline. Tax return filing and payment deadlines extended by two months March 23 2020. Deceased persons estate Association.

Form E Important Notes. First is to determine if you are eligible as a taxpayer 2. Tax Filing 2022 Deadline Malaysia E Jurnal from ejurnalcoid.

Rental from property in Malaysia and is not confined to your salary from employment. 2021 income tax return filing programme issued. Employment income BE Form on or before 30 th April.

An individual who earns an annual income exceeding RM41000from Malaysia must register a tax file and file annual tax returns. Individual income tax return No business income With business income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period - based on method of submission Electronic filing 1 month. 30 days before the beginning of the basis period.

By 30 April without business income or 30 June with business income in the year following that YA. Tax return filing and payment deadlines extended by two months March 23 2020. File your income tax online via e-Filing 4.

Other entities Submission of income tax return. Maximising your tax relief and rebates to get your money back 6. The Inland Revenue Board IRB has recently made available on its website the 2021 income tax return filing programme 2021 filing programme titled Return Form RF Filing Programme For The Year 2021.

The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of. By 31 March of the following year. The 2021 filing programme is broadly similar in concept to the position laid out in the.

Form P refers to income tax return for partnerships. Workers or employers can report their income in 2020 from march 1 2021. The main tax day usually falls on april 15.

1 a deadline extension to may 15 2022. Individual Tax in Malaysia. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN.

For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. Form B Form B deadline. SOLE PROPRIETOR Form B.

As for those filling in the B form resident individuals who carry on business the. During an audit a tax agent would check all information related to your income and expenses. CompareHeromy April 5 2021 14360.

Taxable income includes all your income derived from Malaysia eg. Ensure you have your latest EA form with you 3. Of tax professionals will be able to assist you in the aspect of tax planning and compliance so as to comply with the Income Tax Act.

Tax Deadline Year 2022.

Cheap And Effective Web Hosting Solutions Tax Deadline Types Of Taxes Self Assessment

Tax Filing Deadline 2022 Malaysia

Ebi Software Kindly Take Note On The Income Tax Submission Deadline In 2022 For 2021 Calendar Year To Avoid Penalty Ebi Ebipos Ebisoftware Possystems Taxsubmission Incometax Lhdn Taxseason2022

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Cheap And Effective Web Hosting Solutions Tax Deadline Types Of Taxes Self Assessment

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

How Much Do You Need To Save For Your Children S Higher Education Created In Free Piktochart Infogra Educational Infographic Childrens Education Education

The Times Group World Finance Economy Finance

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

How Much Do You Need To Save For Your Children S Higher Education Created In Free Piktochart Infogra Educational Infographic Childrens Education Education

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Analytics Deloitte Tax Analytics

Here S What To Do If You Missed The April 18 Tax Filing Deadline

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Important Dates For 2022 Tax Returns Leh Leo Radio News

Irs Announces 2022 Tax Filing Start Date

Business Tax Deadline In 2022 For Small Businesses